Pickle.Finance on Polygon - DAI Staking

30. June 2021

No financial advice - Make your own research

This investment strategy is based on one single stable coin added to a yield pool and then staked to earn rewards.

The transactions are executed on the Polygon network and uses two decentralized exchange:

- AAVE

- PICKLE.FINANCE

Let's assume an initial investment amount of US$ 10'000

First of all we need the stable coin DAI:

- DAI (US$ 10'000)

In case that you do not own any DAI but another crypto currency like USDC, ETH, BTC, MATIC then you can invest them in AAVE on Polygon and borrow DAI.

Currently you would pay a low interest rate and receive some MATIC tokens by using the AAVE lending platform.

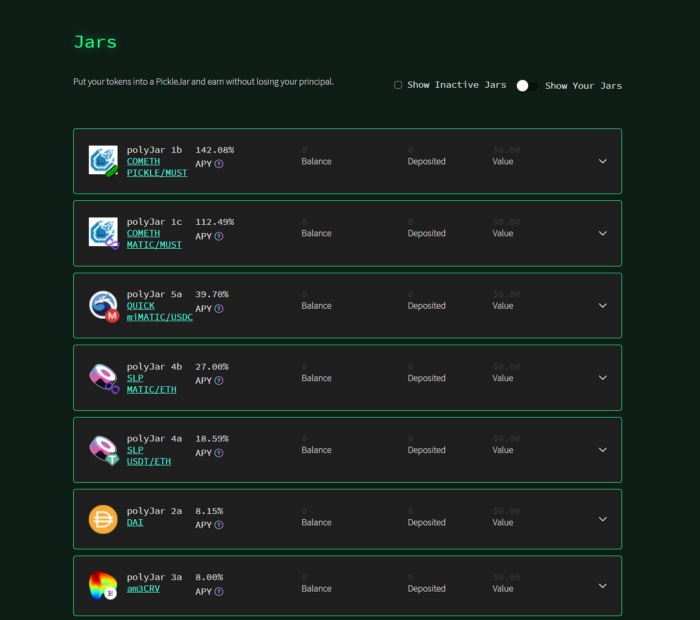

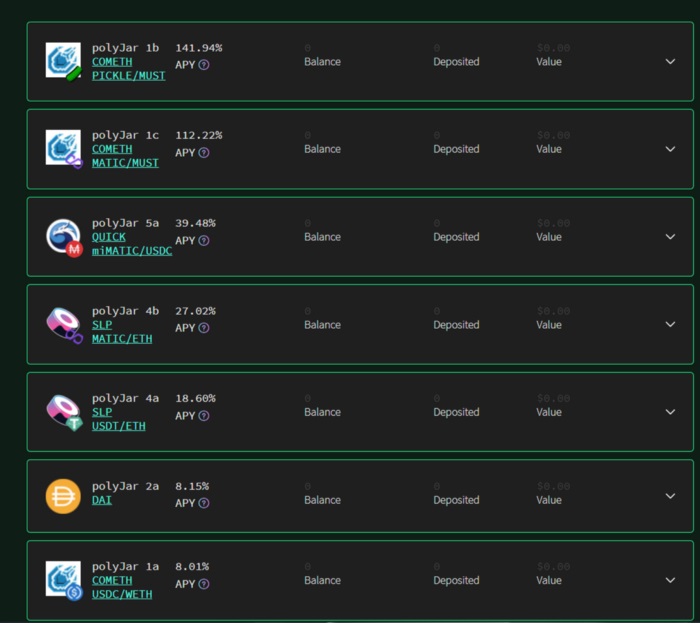

Once you have DAI then you add them into the polyJar 2a JARS on Pickle.Finance.

Then you go the FARMS on Pickle.Finance and deposit your DAI liquidity pool tokens. Immediately you start earning PICKLE, MATIC and LP fees.

| Snapshot |

Quotes |

Borrowing DAI |

|

Liq.Pool Farming |

| 30.06.21 |

USDC/DAI: 1.00 |

DAI: -3.82% (APR)

MATIC: 2.45% (APR) |

|

DAI: 19.08% (APY) |

| Analysis |

Investment |

Daily ROI |

Weekly ROI |

Monthly ROI |

| 30.06.21 |

$ 10k |

$ 5.22

0.05% |

$ 36.6

0.37% |

$ 157

1.57% |

| History |

Investment |

ROI (Daily) |

APR |

USDC/DAI |

| 30.06.21 |

$ 10k |

$ 5.2 |

19.08% |

1.00 |

| 01.07.21 |

$ 10k |

$ 5.2 |

19.08% |

1.00 |

| 02.07.21 |

$ 10k |

$ 5.0 |

18.22% |

1.00 |

| 03.07.21 |

$ 10k |

$ 5.1 |

18.71% |

1.00 |

| 04.07.21 |

$ 10k |

$ 5.1 |

18.46% |

1.00 |

| 05.07.21 |

$ 10k |

$ 4.8 |

17.55% |

1.00 |

| 06.07.21 |

$ 10k |

$ 5.0 |

18.27% |

1.00 |

| 07.07.21 |

$ 10k |

$ 4.9 |

17.80% |

1.00 |

| Total |

$ 10k |

$ 40.3 |

18.4% |

|

Strategy update 30. June 2021:

Pickle Finance has launched on Polygon, with a liquidity mining program for both MATIC and PICKLE rewards available.

Strategy update 8. July 2021:

Pickle price is under pressure with the general downtrend in crypto. The interest rate is still at a good level for DAI. This strategy is now closed.

For more information get in contact with us directly via contact form, twitter, facebook